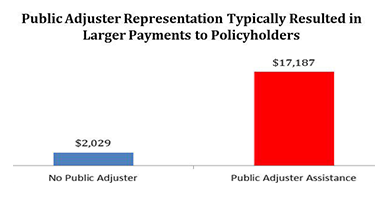

What is the advantage of using a Public Insurance Adjuster?

Public adjusters file the claim on the policyholders behalf and negotiate a satisfactory settlement with the insurer. Public adjusters are the only kind of adjuster that works executively for you. In the process of filing your claim, you will probably encounter different types of adjusters.

- A Public Insurance Adjuster works only for you, the policyholder.

- A Company Adjuster, often called the insurance adjuster, works for, and is employed by the insurance company and looks after the insurance company interests.

- An Independent Adjuster also works for the insurance company and works for the insurance company interests. Independent Adjusters are subcontractors for the insurance companies.

At TAG (The Adjusters Group, LLC), our licensed and bonded Public Adjusters work exclusively for you, the policyholder, never the insurance company. The Adjustors Group is an authority in loss adjustments, offering over 18 years of experience in handling commercial and residential insurance claims for the policyholder, along with 40 years in the construction industry. Our goal is to ensure our clients a prompt recovery of the most reasonable compensation for their claim. We do not receive a fee until your claim is paid.

How TAG can help you?

- Savings: We will save you time and confusion of filing your claim alone, or letting the insurance company decide how much it should pay for your loss. It should be your choice!

- Free Consultation: We are here to review your policy, inspect your property Damages, and advise you of your options for free. After the consultation, you decide if want to take advantage of our services, there is no obligation.

- Claims Expertise: We are authorities in settling insurance claims. We understand insurance policy language, associated laws, procedures, and the necessary documentationthat is needed to complete a claim. This allows us to properly submitand maximize your claim.

- Construction Expertise: We are unique to many other public adjusters because we offer over 40 years of construction industry knowledge. We go beyond inspecting the surface Damages. We spend extra time to evaluate all areas that could be affected. We are highly skilled to assess primary and secondary Damages, and experienced to give a realistic estimate on the cost for repairs.

- Advocacy: We negotiate with your insurance company on your behalf, and protect your rights and interests.

- Accessibility: We keep you informed of your claim at every major milestone, and are available to you 24-hours a day, 7 days a week.

- Claim Satisfaction: We ensure the maximum, fair value for your claim with less hassle and frustration to you.

featured

ARTICLES

-

Florida Approves 5.2% Rate Cut for Workers' Compensation

The Florida Office of Insurance Regulation said it has approved an overall decrease of 5.2 percent in workers' compensation insurance rates in Florida, the first decrease in four years.

As expected, The National Council on Compensation Insurance (NCCI), which represents about 250 insurers, submitted a new rate filing at the direction of the OIR, following OIR's disapproval of NCCI's rate filing request for an average 3.3 percent decrease.

Insurance Commissioner Kevin McCarty signed the final order making the new rates effective January 1, 2015 for both new and renewal policies.

To read more: http://www.insurancejournal.com/news/southeast/2014/11/13/346996.htm -

Florida Gov. Scott Facing Rising Seas, Climate Change Politics

When Florida Governor Rick Scott won re-election Nov. 4, he triumphed over both his Democratic challenger and California billionaire Thomas Steyer, who spent $20 million painting him as a climate-change denier.

Scott, a 61-year-old Republican who during the campaign deflected questions about the topic by asserting that he isn't a scientist, has little time to celebrate.

Environmental issues are washing onto his desk: Voters required lawmakers to devote about $1 billion annually to conservation; Florida must curb carbon emissions almost 40 percent under new federal rules; and rising seas are soaking Miami Beach even as Scott's party blasts President Barack Obama's deal last week with China setting emissions goals.

Scott's predicament shows how Republican leaders from Alabama to Arizona are facing unwanted climate-change battles even as they question the effects of human activity on global temperatures. The governor must spend the money while placating members of his party and Mother Nature alike.

To read more: http://www.insurancejournal.com/news/southeast/2014/11/17/347191.htm -

State Farm Enhances Claims Reporting App with Object Recognition Technology

State Farm has added object recognition technology to their Pocket Agent app to make submitting an auto claim via a mobile device easier and simplify the claims process. This new technology reduces the need for typing by using the mobile camera to record important claims information. Customers can capture an image of the other vehicle to process and populate the make and model data automatically into claim form fields.

Pocket Agent provides a number of features to registered State Farm customers, including the ability submit a claim from anywhere. The app also uses customer information to simplify the auto claims process by selecting policy information, rather than typing it in.

To read more: http://www.insurancejournal.com/news/national/2014/08/28/338976.htm -

Commercial-Focused Claims Software: A Must for Customer Satisfaction, Process Efficiency and Cost Reduction

"Square pegs into round holes: something that will not succeed as attempted, except possibly with much force and effort." Wiktionary

This Wiktionary definition is a remarkably accurate description of the use of personal insurance-designed claims software by commercial insurers over the last decade or so. Many commercial insurance firms (CL) have adapted personal insurance (PL) claims software to their commercial claims processes and, with much force and effort and a certain measure of ingenuity, have made some progress ? but not as much as attempted or possible today. Why do so many commercial insurance companies continue to use claims software designed for personal insurance ? a significantly different business process?

Until recently, commercial insurers simply had no other option. Personal insurance firms led the way toward more efficient, customer-focused claims processes 10-15 years ago, and software companies quickly responded with programs to fit their needs. Commercial insurance was much slower to catch on.

To read More: http://www.claimsjournal.com/news/national/2014/11/12/257622.htm

*Percentage is based on total of all claims handled. Individual claims vary. Some claims settle for less than the 825% and some settle for more. "Original Offer" means: The monetary amount the Insurance Company originally estimated the property Damages value as, and offered/paid to the insured in order to induce settlement of the claim.

Our video spokesperson is a paid spokesperson, not a licensed public adjuster.